How can smaller alliance programs prosper?

27 January 2015

In the very early days of alliances, there was this vision of one global Frequent Flyer Program for each alliance. For reasons we all know, this vision has never come true – and it might actually be better like that.

Each (or almost each) alliance member having its own FFP adds some necessary competition to the market. This does not prevent alliances from harmonising certain benefits, notably for tier members. But merging all FFPs would obviously pose various practical challenges, from customer ownership and related liability management issues to handling of cases when airlines switch their alliance affiliation.

As a result, there are now 19 individual FFPs within Star Alliance, 17 in SkyTeam and 16 in oneworld (talking about the FFPs, not the number of alliance members). While the biggest wave of additions of new members might be over at all three alliances for now, there are still some latecomers expected to join, from Royal Air Maroc to Gulf Air and Air Astana. Or existing alliance members like Copa or Brussels Airlines are about to launch their own FFPs (rather than co-branding the FFP of a bigger partner) and find themselves therefore in a comparable situation as new alliance members when it comes to the question of entering the FFP game at an alliance level. But as experience of all the latest additions has shown, it seems to be increasingly difficult to position its FFP successfully in such a competitive environment among friends.

Whether you look at the programs of Air India, EVA Air (Star), Aerolíneas Argentinas, Garuda (SkyTeam) or Malaysia Airlines and SriLanka (oneworld): They have all failed to introduce that required element of differentiation making these programs really a required choice for regular customers. While Spain and the US are certainly important markets for Aerolíneas, you definitely need a lot of unconditional patriotic love to favour the Aerolíneas Plus program over the dominant local partner programs of Air France KLM or Delta when living in these markets. Just introducing the basic earn/burn relationships and standard tier benefits might help, at best, to keep its own local core customers, but doesn’t let the program appear on the radar of anybody else, notably not abroad.

So unfortunately being late at a game such as airline alliances comes with a price: You need to do more at the FFP level. While it might be easier to leverage other alliance-related benefits (notably in terms of sales) even as a late comer, the picture is different when it comes to FFPs. Keeping in mind that it is all about customer ownership and customer insights thanks to FFP data, a late comer has only two chances to be successful in the FFP game: Its program needs to be more generous and it needs to be more relevant to those customers it really wants to target. And this is obviously something nobody at the alliance has told you before, as their unilateral focus is on meeting the alliance’s technical and operational requirements.

So if, as an example, EVA Air decides that it wants to target the market of Hong Kong expats in Vancouver, it does need to make sure that Evergreen Club members flying on EVA Air through Taipei rather than nonstop on Star partner Air Canada earn considerably more miles with EVA Air (not done), that award tickets are cheaper on EVA Air than on Air Canada (done), that elite members enjoy significantly more benefits on EVA Air than on Air Canada (partially done) and that the program incorporates specific elements of differentiation aimed at this clearly defined target group, which can’t be found in the local Aeroplan or any other program (not done). Even if some of the boxes can be ticked as in the example above, it is not sufficient to make the real difference. Anything short of ticking all the relevant boxes will deliver sub-optimal results only – while producing the same costs and efforts. Without knowing any figures, it is safe to assume that at least 80% of the above described target group opts today for Aeroplan rather than for Evergreen Club when flying on EVA Air.

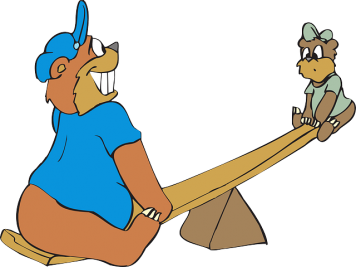

But the good news for anybody realising shortcomings after the first euphoria about joining an alliance has faded away is that it is never too late to take corrective measures. As soon as you realise that the penetration of partner FFPs among your clients gets too high (and depending on your airline and market, this share should not exceed 10-30%), you should balance the costs of paying out to partner FFPs for mileage accrual each month versus the necessary investment into making your own program more attractive and appealing. The second option risks making much more sense from a business perspective in the medium and long term.